Flows data suggest ESG assets are stickier.

Hello from Impact Delta.

Enjoy our periodic newsletter, containing insights and news related to ESG and impact investing. In this edition, we look at how the Biden administration is forced to balance short term inflation with long term climate impacts, how investors are valuing fast fashion and alternative proteins despite their opposite environmental profiles, and does the data indicate ESG investors are more patient than others?

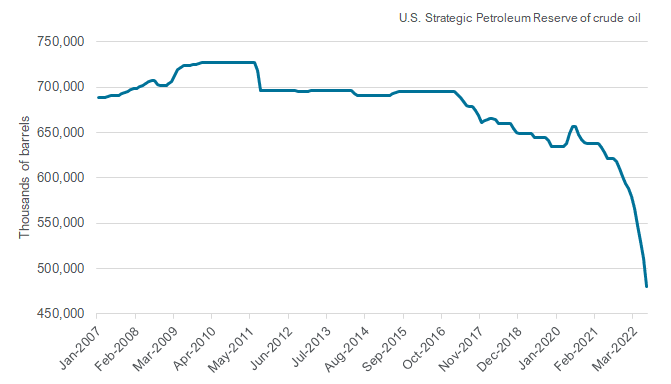

US SPR activity might encourage oil industry to develop more capacity - The US is in the process of selling 200 million barrels of oil from the Strategic Petroleum Reserve (SPR) in an attempt to reduce the inflationary pressures of higher oil and gasoline prices. A proposal to replenish these barrels by purchasing them in 2023 and 2024, but at current prices, is what's counter to the climate objectives of the Biden administration. The motivation for this is to encourage more production that isn't happening as producers are concerned the price will decline over the next year. This illustrates the political reality that fighting near term inflation is more compelling than addressing climate change by reducing fossil fuel production. The average cost of oil in the SPR is $29.70/barrel against a July 26th WTI price of 94.98. So, if prices do fall, the cost of replenishing the reserves will be a bigger cost to the government under this plan, effectively providing a multi-billion dollar subsidy to the industry.

Fast Fashion - The recent fund raise of the Chinese fast fashion company Shein at a $100 billion valuation illustrates investor appetite for the industry. However, it's environmental footprint is equally as sizable as its valuation. A World Bank report identifies that the fashion industry is responsible for 20% of wastewater worldwide, and it contributes to 10% of greenhouse gas emissions, which is more than air and maritime transit combined. Shein's valuation implies that investors are not anticipating any carbon tax or other environmental constraint to the fast fashion industry, to which we would reply, caveat emptor.

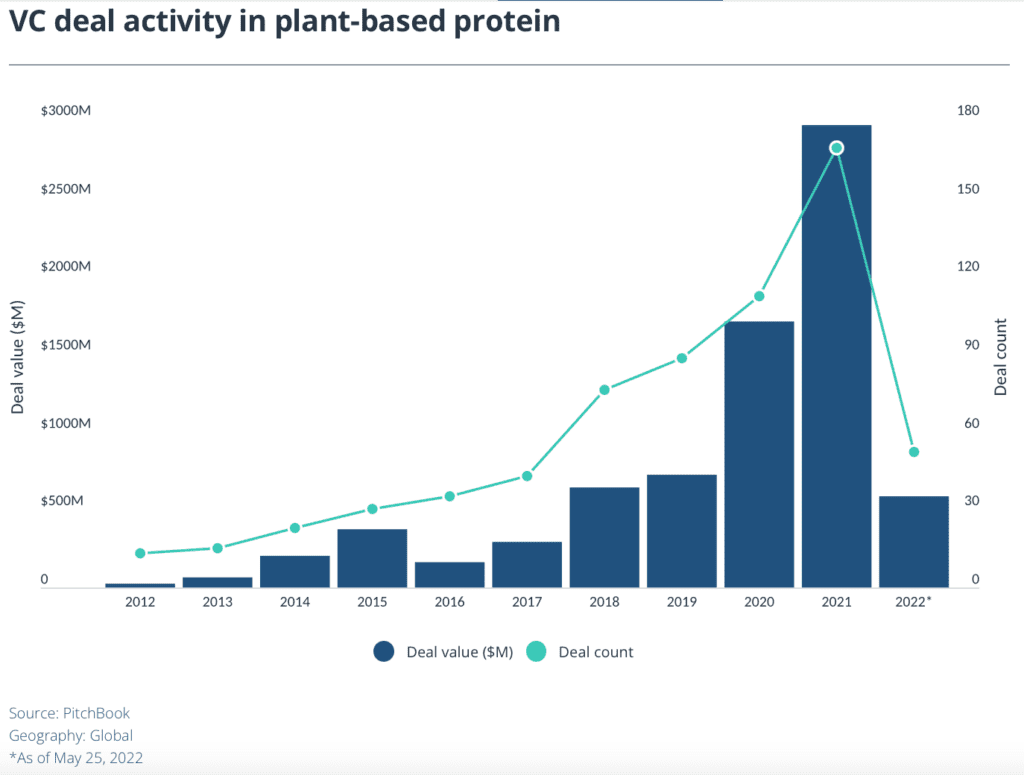

Alternative Protein - Unlike the continued enthusiasm for fast fashion, The VC funding for alternative proteins has slowed dramatically compared to the past few years. This is despite increased uptake of alternative proteins across both dairy and meat products. A recent research report from Global Markets Insights predicts 17% compound growth from $60 billion in 2021 to over $190 billion in 2028. It will be interesting to watch if the perceived economic slowdown affects the adoption of these new protein solutions, and if the VCs pullback will look wise in retrospect.

Are ESG investors 'sticky'? - As we noted in the last new letter, oil ETFs have outperformed clean energy ETFs by roughly 35% in 1H 2022. Surprisingly, the most recent data from Morningstar indicates that sustainable funds have continued to have net inflows in 1H 2022, while the main fund market saw slight outflows. The more notable shift is from active sustainable funds to passive sustainable funds, largely reflecting the recent outperformance of the passive strategies. With the underperformance of the sustainable funds due to exclusion of oil and gas, it's surprising that the outflows haven't shifted the other way, implying sustainable fund investors may be more long-term oriented and therefore 'sticky' than other investors.

Feedback is always encouraged and welcome. If this was shared with you, you can subscribe here.

About Impact Delta

A secular shift towards a more responsible capitalism is underway. Impact Delta is a specialist consultancy founded to help investment firms capitalize on this shift. We believe good environmental and social thinking helps investment firms raise capital and earn better returns. More about us here.