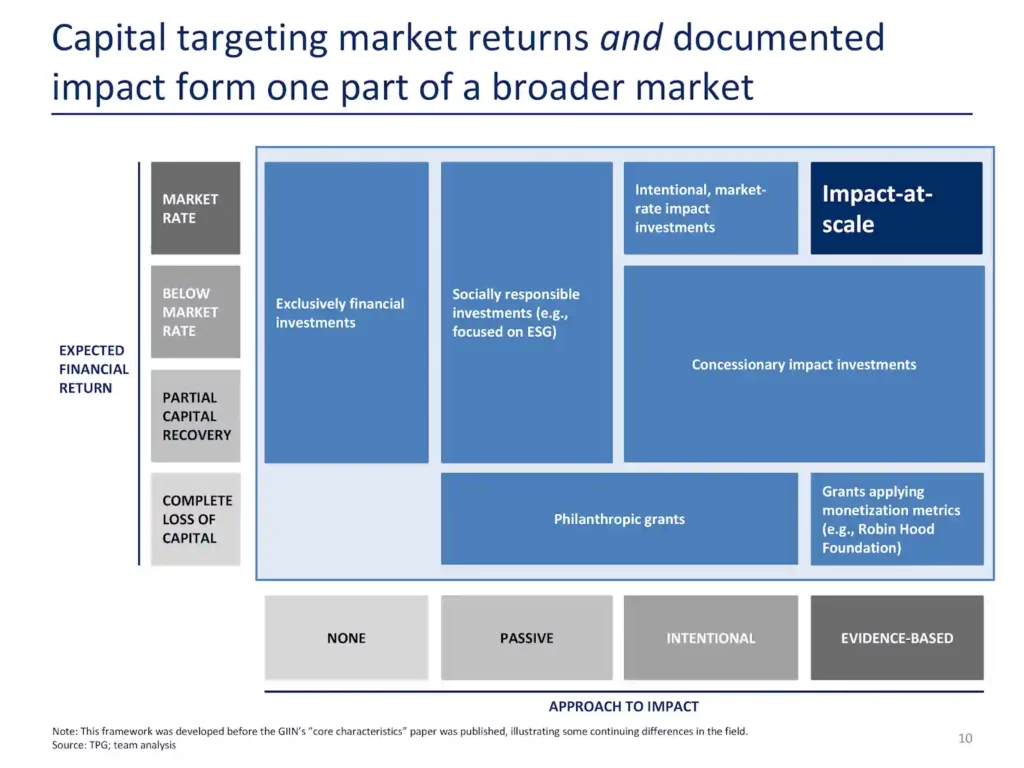

In April 2019, The Global Impact Investing Network (GIIN) published a set of principles to help determine what counts as impact investing. These complemented its existing framework, below:

U.S. state pension plans, among other large institutional investors, generally have a fiduciary duty to seek market-rate returns for their plan participants. Hence, they are often precluded from investing in impact strategies unless item #3 is not concessionary — no matter what the societal benefits might be.

If an investing firm can credibly seek to achieve market-rate returns and rigorously document its impact, then the pools of capital available to impact investors increase by orders of magnitude. This is what TPG and Bain found when they launched in 2016. The chart above, originally developed by TPG, is a useful framework for placing different types of market participants in the right category.