In this issue, we highlight the challenge of reducing carbon and hitting Paris climate targets. We review how banks are making slow progress, the small number of companies responsible for most greenhouse gas emissions, the energy requirements and climate implications of AI, and the Science-Based Targets initiative’s (SBTi) controversial recent statements about carbon offsets. We also take a look at recent government policy changes that have watered down their own transition commitments. Together, these topics highlight the need for innovative and efficient financing solutions for transitioning the real economy.

1. Net zero banks don't seem to finance less carbon A recent Columbia business school study on net zero commitments made by banks made discouraging reading. 138 banks, representing over 40% of global banking assets, have set net zero targets under the Net Zero Banking Alliance (NZBA) – yet the study finds that these commitments have not led to meaningful change in bank behavior. Specifically, NZBA banks have not divested from financing high-carbon sectors nor accelerated their engagement in a net zero future. The report finds that “net zero banks do not differentially divest from targeted sectors relative to banks without a net zero commitment.” Despite this, the ESG ratings of these banks tends to improve after making a net zero commitment. This leads us to believe that over the next 12-24 months, the banks making the most progress will be rewarded, while the “greenwashers” will be exposed and the ESG-related reputational benefits they have so far enjoyed will reverse.

2. 57 companies contribute 80% of emissions A recent article from the Carbon Majors database highlights how the carbon intensity is concentrated in the oil, gas, coal and cement industries. Roughly 57 companies are estimated to be responsible for 80% of the emissions produced since the Paris Accord in 2015. One of the features of this analysis is that it includes not just scope 1 and 2, but also scope 3 emissions, which includes the downstream use (e.g., the use of cement in a building project) of their products. In this sense, solutions that can help reduce scope 3 emissions (e.g., mechanisms that can accelerate adoption of green cement or other transition-aligned technologies) are key near-term drivers for progress, as consumption of oil, gas, coal and cement are not falling quickly enough to hit Paris targets.

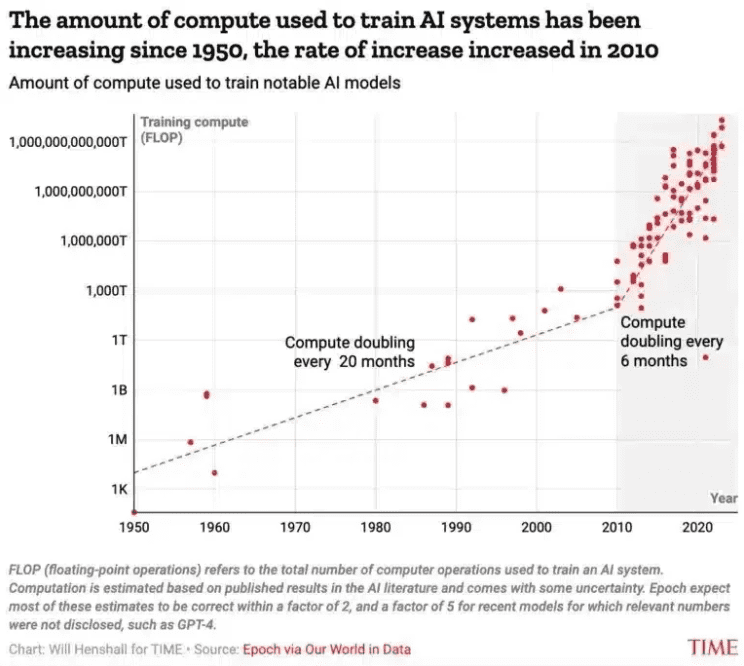

3. AI’s energy needs are growing fast Over the past year, AI has captured society’s imagination. What is receiving less attention is the enormous energy and carbon cost of improving the technology. The power usage of a typical AI querry is roughly 10x that of a typical google search query. The head of semiconductor company ARM indicated that at current trajectories, AI will US drive data center power demand from 4% today to 25% by 2030. For as long as most grids are still partially fossil powered, AI may be a substantial net driver of emissions over the next few years.

4. The SBTi seemed to wobble this month The SBTi surprised many observers last week when it announced that it was permissible for companies to use environmental attribute certificates (EACs) to offset emissions from their supply chains (i.e., their Scope 3 emissions) to meet their science-based targets. It’s easier to buy offsets than it is to actually transition your company’s supply chain, and some companies may have pushed SBTi to make life easier for them. In addition to being a rather stunning statement from a group that has largely focused on changing systems, it proved to be equally stunning for the organization itself. The staff of SBTi indicated that it was the sole decision of the board and CEO, with limited-to-no consultation from staff or industry experts. The staff, threatening mass resignation, called for the resignation of the CEO and any board members that supported this announcement. The board has since backtracked and indicated its policy on offsets has not changed, and any amendments to that policy will be announced in July after consultation internally and externally with scientific experts.

5. Governments are also bowing to pressure to water down commitments – Here’s a list from recent work by Bloomberg (here’s the extended executive summary of BloombergNEF’s G-20 Net Zero Carbon Policy Scoreboard, published in early April). We quote directly – but the point is that governments are finding it hard to stick to commitments too, increasing uncertainty across the board.

“The weakening climate ambitions of the world’s biggest economies is increasing uncertainty among consumers, industry and investors — a subject that will likely set the tone for many discussions at BNEF’s summit in New York this week.

“There are a number of reasons top ranked G-20 members lost points on BNEF’s ranking. In some cases, governments scrapped low-carbon programs with little warning. For example, in December 2023, Germany announced unexpectedly that it would accept no further applications to the electric vehicle purchase subsidy program, which had been due to end in 2024. As a result EV sales dipped 16% in 2023 compared with a 14% increase across the EU as a whole.

“The last year has also seen European policymakers weaken or backtrack on low-carbon regulations. EU lawmakers reached a provisional deal at the end of 2023 to allow an exemption to the rules on mechanisms to ensure sufficient electricity generation capacity. This would effectively mean that national governments can continue to subsidize coal-fired power plants until at least 2028. The bloc and its member states also lost points for weakening measures to promote low-carbon farming and proposing to change the green conditions imposed on agriculture subsidies into a voluntary system.

In addition, these countries pushed back key policy dates: France delayed its coal phase-out by three years to 2027. Meanwhile the UK deferred its bans on sales of new vehicles with an internal combustion engine and on fossil-fuel boilers. It also postponed the start of the Clean Heat Market Mechanism, which will set a quota for heat-pump sales for a certain number of fossil-fuel boilers. The US lost points for the delays to the rules regarding the Inflation Reduction Act incentives, causing low-carbon project developers to put final investment decisions on hold.

“Governments justified these moves by pointing to factors like stretched public budgets. UK Prime Minister Rishi Sunak called it a “new approach to net zero” in September 2023. While these rollbacks may give some companies short-term relief, they also increase uncertainty among industry players and consumers, hinder planning and investment and call into question policymakers’ overall commitment to climate action.”

Conclusion

Taken together, these developments highlight that addressing scope 3 emissions is hard. Proving claims is hard, but progress is being made on that front. Many large companies, with large supply chains, have made science-based commitments. They are now grappling with how their buying power can the transition faster in partnership with their suppliers. Market-based solutions, which (crucially) help to drive transition in the real economy are a space to watch.