In this issue, we look at how the proliferation of climate frameworks is an opportunity for AI to harmonize analysis. Even with the best climate frameworks, there's the question of whether accounting for carbon as opposed to reporting it will drive better outcomes. We'll also look at how governance is (again) often taken for granted and ends up hindering otherwise promising organizations. Finally, we'll look at how water remains an issue (and potential investment opportunity) in different ways in different areas.

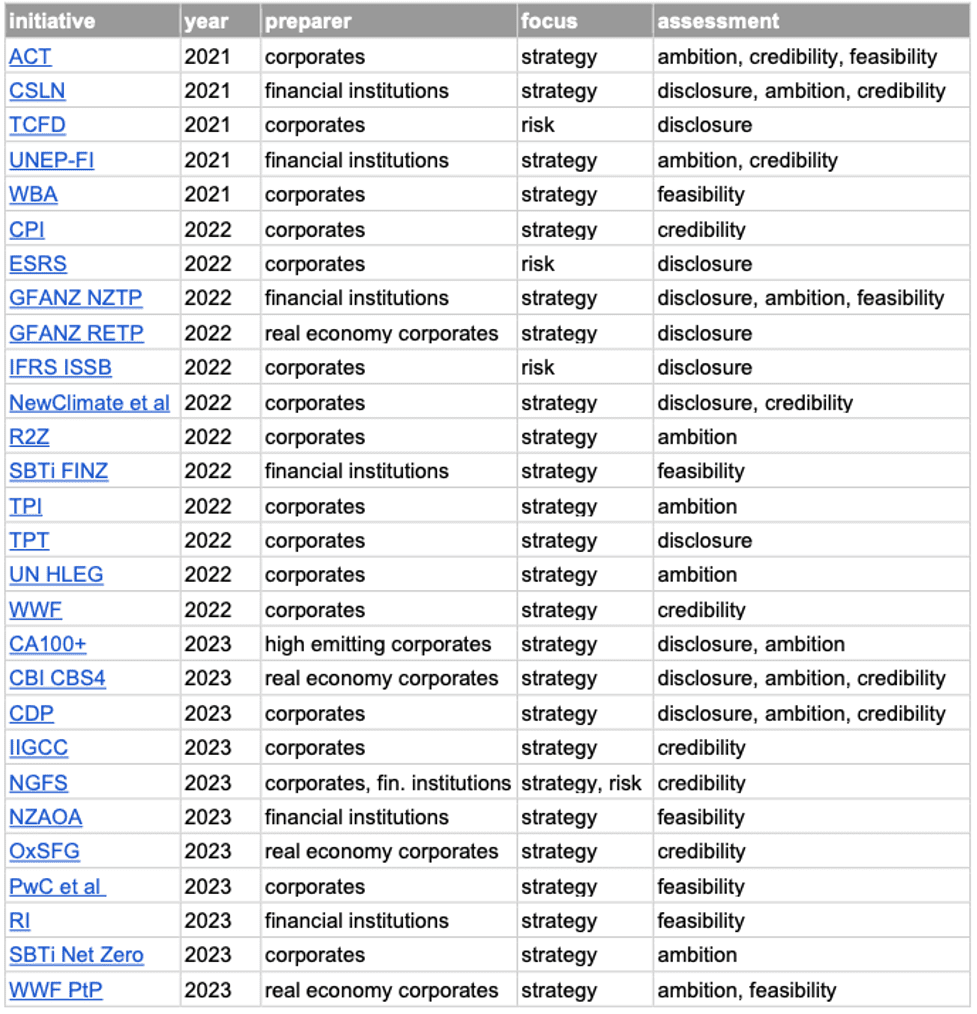

One climate framework to rule them all? - Over the past few years, the number of climate frameworks has proliferated tremendously. The list below captures most of the frameworks for context (from the report - Net Zero Transition Plans: Red Flag Indicators to Assess Inconsistencies and Greenwashing)

Obvious challenges this presents include the decision of which framework to use, and, as an investor or asset allocator, how to compare different companies or assets if they use different frameworks. WWF, in partnership with the Universities of Oxford and Zurich, is piloting an AI tool to try to collect the common factors among the different frameworks to enable better comparability. While this pilot is expected to be up and running by the end of the year, we'd also refer back to last month's newsletter where we highlight highlight 15 Rock as an AI solution for climate analysis that is up and running today, albeit not one that is focused on analyzing framework-overlap.

Is reporting missing the point because accounting is the core need? – Reporting of climate data is, then, characterized by a range of approaches, with Scope 1,2, and 3 emissions almost the only the metric common to them all. Some observers wonder whether merely reporting the data is sufficient to drive behavior change. A team from Stanford University has proposed a different solution, which isn't measuring and reporting carbon, but accounting for it, much as one accounts for financial performance. If carbon were to be added to a balance sheet (either as an asset or liability depending on the company), that provides a concrete way to tie emissions to financial performance. This would motivate companies to "only emit greenhouse gases if the value created exceeds the cost of reversing the emissions".

Best of intentions waylaid by the 'G' in ESG – The focus on the 'S dramatically increased after the George Floyd murder in 2020, while the 'E' has received tremendous focus ever since the Paris Agreement in 2015. What has sometimes been assumed to be well in hand is the 'G' of governance. As we pointed out in a prior newsletter, the 'governance gap' between large-cap companies with best practices and smaller companies that often lack best-in-class governance practices remains a challenge. With the dramatic downsizing of the Center for Anti-Racist Research, the application of best practice oversight is sometimes lacking in smaller social sector organizations as well. For investors, or even individuals that also provide philanthropic capital, the lesson seems to be that the 'G' should be assumed to be lacking, until proven otherwise.

Water water everywhere, and (sometimes) nary a drop to drink - New York and New Orleans are reflecting two different ends of the spectrum of water impacts. In the case of New Orleans, the lack of rainfall has caused the salt water from the Gulf of Mexico to move further upstream, potentially affecting the city's drinking water supply as early as the third week of October. By contrast, NYC experienced a rare bout of flooding over the weekend. The volatility in rainfall and geographic dispersion of this impact is likely to continue to create these dislocations as a byproduct of climate change. Astute investors are likely to see this as an opportunity to invest in ways that will have growth potential and significant environmental and social benefit.

A final thought on Climate Week, credibility, and accountability We were fortunate to attend a range of high-quality events during Climate Week 2023. These discussions, which were hosted by NGOs, private sector and public sector institutions, all touched on the same theme of credibility of commitments. The Science-Based Targets initiative (SBTi) seeks to address this question, and has grown rapidly since launch in 2015. Around ~5,750 companies and 240 financial institutions have committed to setting SBTs, and ~3,450 have SBTs in place (i.e., their plans have been checked and validated). In 2022, 87% more companies had their targets validated than in 2021. As is often the case, private markets firms appear to be lagging their public counterparts. Over 20% of the Fortune 500 have committed, while one large asset owner – widely regarded as a sustainability leader – we spoke to reports ~10% of its stable of PE GPs had SBTi commitments.