In this newsletter, we'll look at how the politicization of ESG and sustainability writ large over the last 18 months has created a stark difference between US and European approaches. This is both in support for ESG initiatives at companies, as well as the political and community support for solar and wind solutions. Despite this backsliding, the climate reality was significantly outside the bounds of normal for 2023, making the political headwinds even harder to understand. The lack of political will for support of ESG initiatives and permitting for projects is a larger barrier to mitigating climate change than capital.

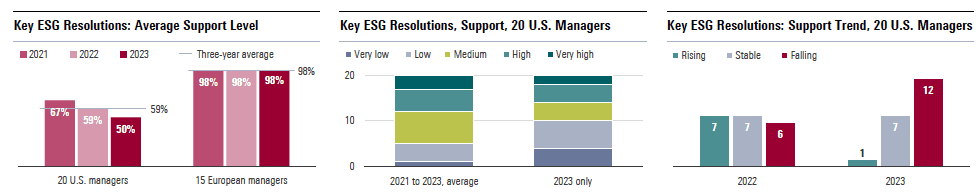

Big asset managers backtracking on ESG/metrics – A recent report from Morningstar tracks the proxy voting of US and European equity managers on ESG topics. Unsurprisingly, Europe continues to lead the way in ESG, with of its 15 largest managers approving 98% of key ESG resolutions. By contrast, the largest 20 US managers have approved a declining percentage of ESG resolutions over the last three years. They supported 67% in 2021 and only 50% in 2023.

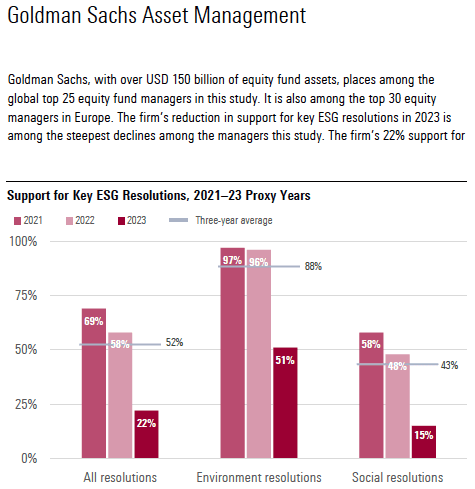

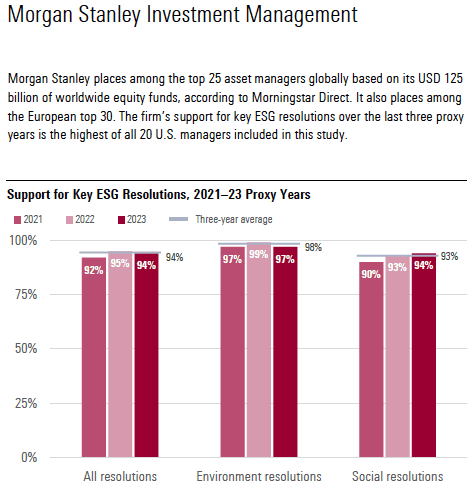

There are exceptions, however, which the charts below illustrate. Morgan Stanley Asset Management looks more like European managers than its US peers, and its support for ESG resolutions is the highest of all 20 US managers included in the study. Goldman Sachs Asset Management by contrast, has retreated from supporting ESG resolutions. The decline in the firm’s support is among the steepest of all managers in this study.

A company suing its shareholders? - In another example of how the politicization of ESG has weakened US resolve on these issues, ExxonMobil has taken the unusual step of suing its shareholders over an environmental proposal that was submitted for consideration at the annual meeting. Arjuna Capital has proposed that Exxon identify Scope 3 emissions reduction targets, something the four Western oil supermajors (Shell, Chevron, BP, and TotalEnergies) have already done. Given weakening support for environmental resolutions from US asset managers, it’s unclear why Exxon felt it necessary to sue to have the item blocked from a vote. It could simply have allowed it to be put to investors, where similar proposals have failed in previous years. Perhaps European asset managers have been buying Exxon stock lately?

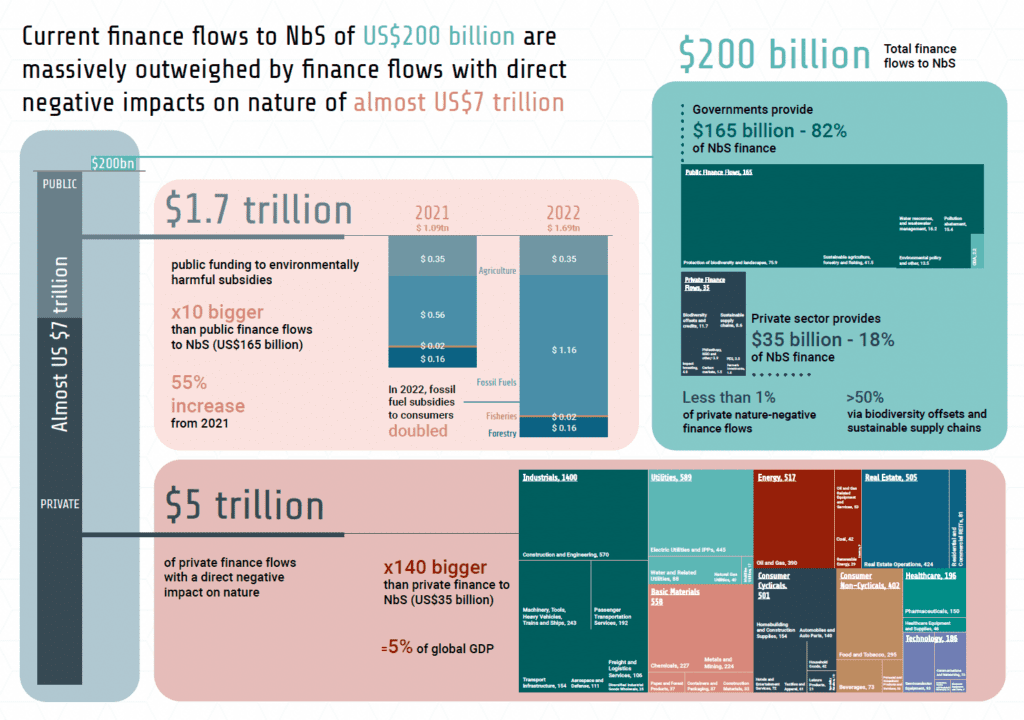

Money isn’t the biggest constraint to addressing climate change - A UN report released at the end of 2023 compared the volume of financial flows into Nature-based Solutions (NbS) with those that have “direct negative impacts on nature.” The conclusion? The “nature-negative” flows amounted to nearly $7 trillion, and the “nature-postiive” to $200bn: an imbalance of 35:1 It is tempting to draw from this that the capital markets are skewed to the status quo over sustainability, but the reality might be more worrying still: In 2022, fossil fuels subsidies to consumers doubled from the year prior. If half of the fossil fuel subsidies were to be directed toward nature-based solutions, the ratio would drop to ~9:1 ($6.2tn to $700bn), and the funding would be sufficient to track with Paris Accord targets.

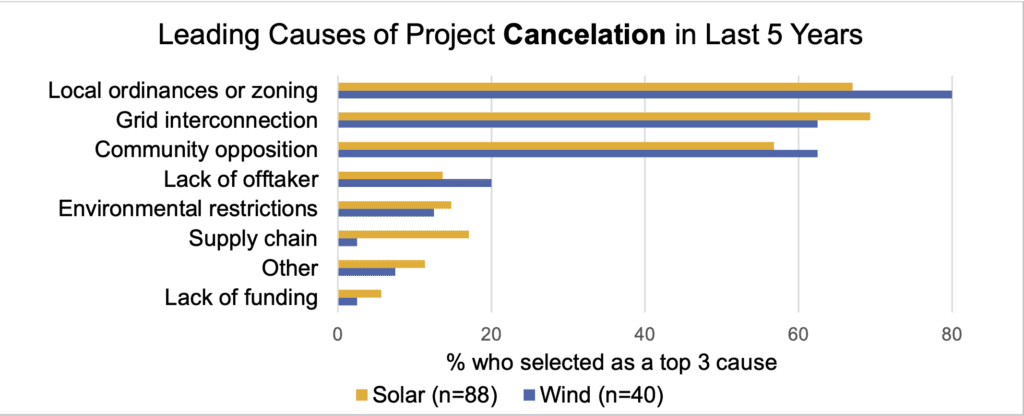

Constraints on wind and solar are zoning permits NIMBY – Lawrence Berkeley National Labs released their latest research on the factors that limit wind and solar development. The top three reasons are: 1) local zoning; 2) grid interconnection; and 3) community opposition. The project-specific items of access to finance or having a power off-taker are rarely a top concern. The permitting/NIMBY challenges led 4 out of 5 developers to be moderately concerned that community opposition will get in the way of decarbonization goals.

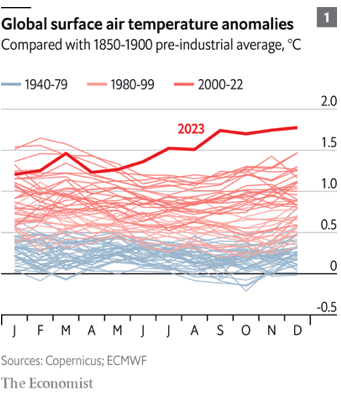

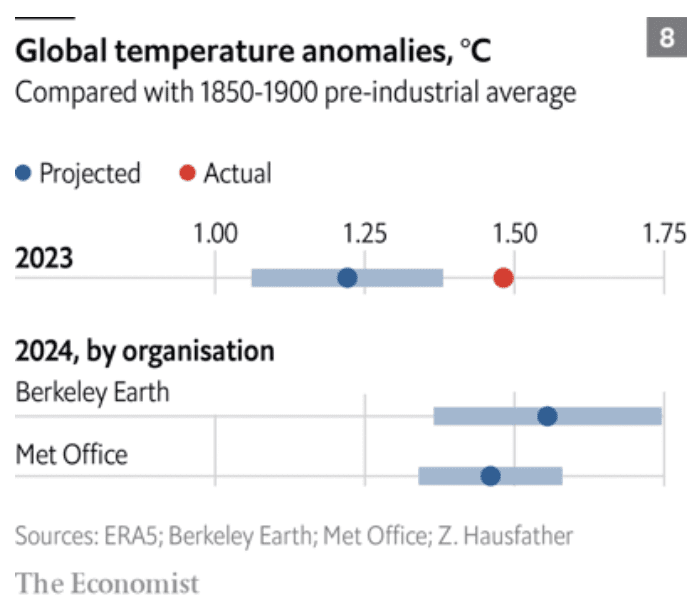

Meanwhile, the earth is burning – While the political winds shift against ESG and sustainability, the climate data is in direct contrast, with 2023 being the hottest year on record. The Economist had several charts and articles on this over the last week, highlighting that it’s been 47 years since a year has been colder than average. For those considering 2023 as a one-time outlier, the current predictions are for 2024 to be equally hot. Here’s hoping the political will and support will shift as the facts outweigh the backlash to ESG and sustainability.