In this month’s newsletter, we look at trends in climate investing and progress ahead of COP 28 in Dubai at the end of the month. We also find a few green shoots among some depressing trends in climate change mitigation efforts that have been politicized and lost momentum in certain geographies.

Is there a ‘COP’ out ahead? – The next UN climate change conference takes place at the end of November, and our expectations for significant progress are low. Oil companies and politicians have recently backtracked on their commitments, which perhaps seems fitting for a conference held in major oil-producing country (Dubai) and chaired by the head of the Abu Dhabi oil company.

Loss and damage progress ahead of schedule – One item that has made progress ahead of expectations is related to a loss and damage fund intended to compensate the countries severely affected by climate change, but which haven't materially contributed to the problem. With the US, China, India and Europe as the major emitters, and China and India relatively recent additions to that list, the US and Europe have made pledges in the past they have not fully funded. The breakthrough in establishing a more formal mechanism came when the smaller countries agreed to start the funding vehicle within the World Bank as opposed to a new entity, which had been their preferred pathway. Given the US and European influence at the World Bank we’ll be watching to see how well this new funding mechanism operates.

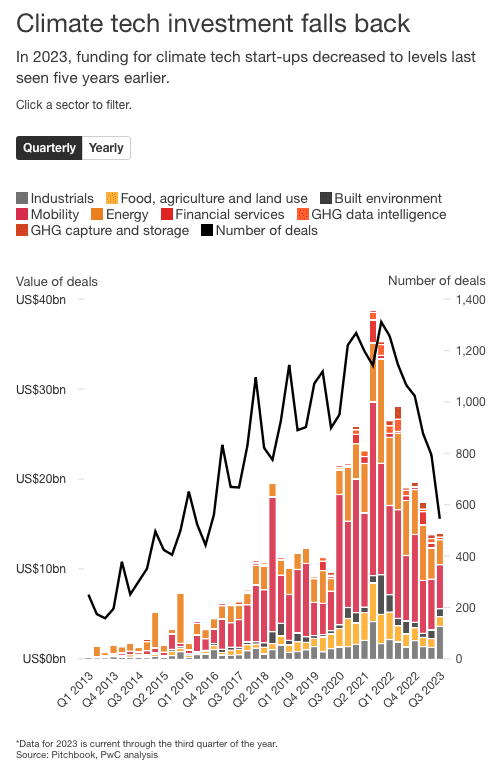

Climate tech venture is plummeting, but reality is a bit more nuanced – Adding to the rather grim climate trends over the past few months, PwC’s latest state of climate technology report finds that climate tech VC funding has declined significantly in 2023.

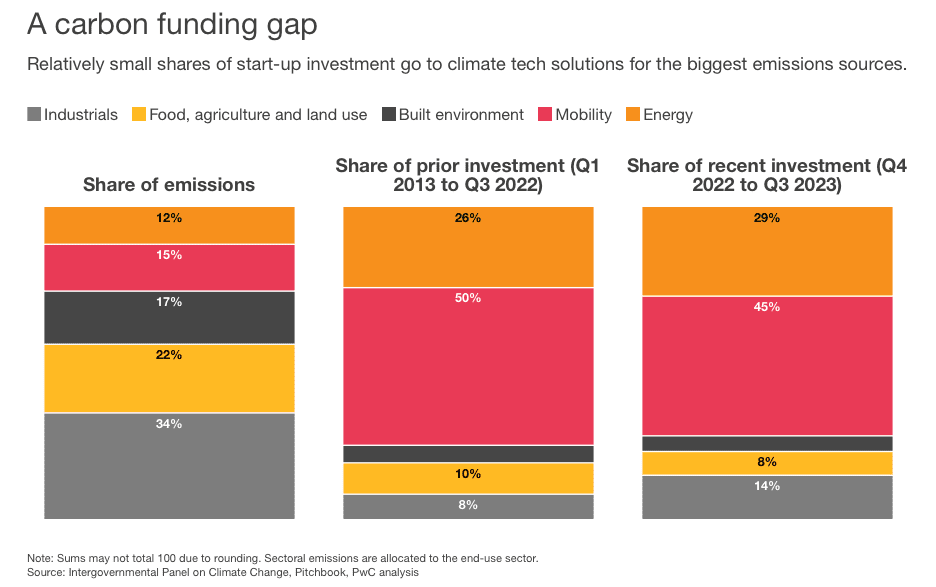

A key driver of this is the decline in investments for sustainable mobility. All sectors saw an absolute decrease in funding, except for carbon capture and sequestration, and financial services, two rather small sectors by absolute dollars. Against an overall backdrop of lower funding amounts, the percentage of capital going toward industrial efficiency is growing, because it declined far less than mobility. This aligns better with the actual magnitude of emissions. We are fans of electric mobility, but when mobility and energy are 27% of emissions but 75% of funding, the market is not efficiently (at least from the climate’s perspective) allocating resources.

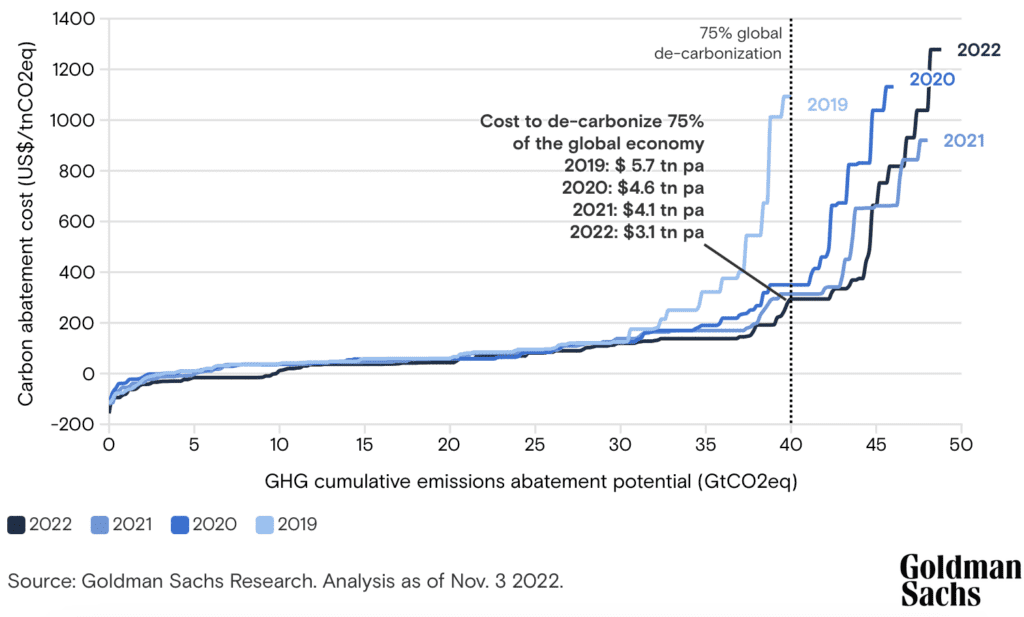

Good news (mostly) on cost to address climate change – The Inflation Recovery Act (IRA) has been one of the bright spots. Goldman Sachs’ Carbonomics report tracks the technology and finance trends associated with climate change mitigation. Some solutions are highly capital intensive, and the rise in interest rates made them more expensive. (Offshore wind is an example.) The good news is that on balance many solutions are getting less expensive, reducing the estimated requirement to hit 1.5· from $5.7 trillion/yr in 2019’s report to $3.1 trillion/year in 2022. If the total cost of the IRA over many years is well over $1 trillion, as Goldman estimates, we would argue it’s money well spent, as the difference between 1.5 degrees and 2.0 degrees of warming is projected to be more than $1.5 trillion per year from flood impacts of sea level rise alone.

As a final positive note, CalPERS has announced it plans to commit $100 billion toward climate solutions by 2030. As climate change is a systemic risk that can’t be diversified away, we believe this is a good investment for achieving the objective of paying for future employee retirement benefits. Given CalPERS’ leadership within the public pension space, we wouldn’t be surprised if this provides a nudge for other public pension plans to make similar (albeit smaller) commitments.

We wish everyone a wonderful fall.