Hello from Impact Delta.

In this issue, we review:

The credibility of climate commitments, and a powerful approach to check them - Many asset owners find that asset managers are more willing to report sustainability performance than ever before. British Columbia Investment Management Corporation (BCI) reported this, for example, in the private equity section of its most recent ESG report:

But how could an asset owner like BCI check (for example) the decarbonization plans of those portfolio companies? A Toronto-based firm, 15Rock, has developed an AI-based approach to address this question (disclosure: we are exploring a partnership). The core idea is to run two contrasting models to test the credibility of claims. One model collects evidence that the portfolio company could be right, using data from the company itself (or from similar companies as a proxy), while the other looks for evidence that the company is wrong. The models then iteratively learn from each other’s points and evidence, to land on an overall assessment. This is the kind of work a team of human consultants/researchers could do, but at higher cost, and lower speed.

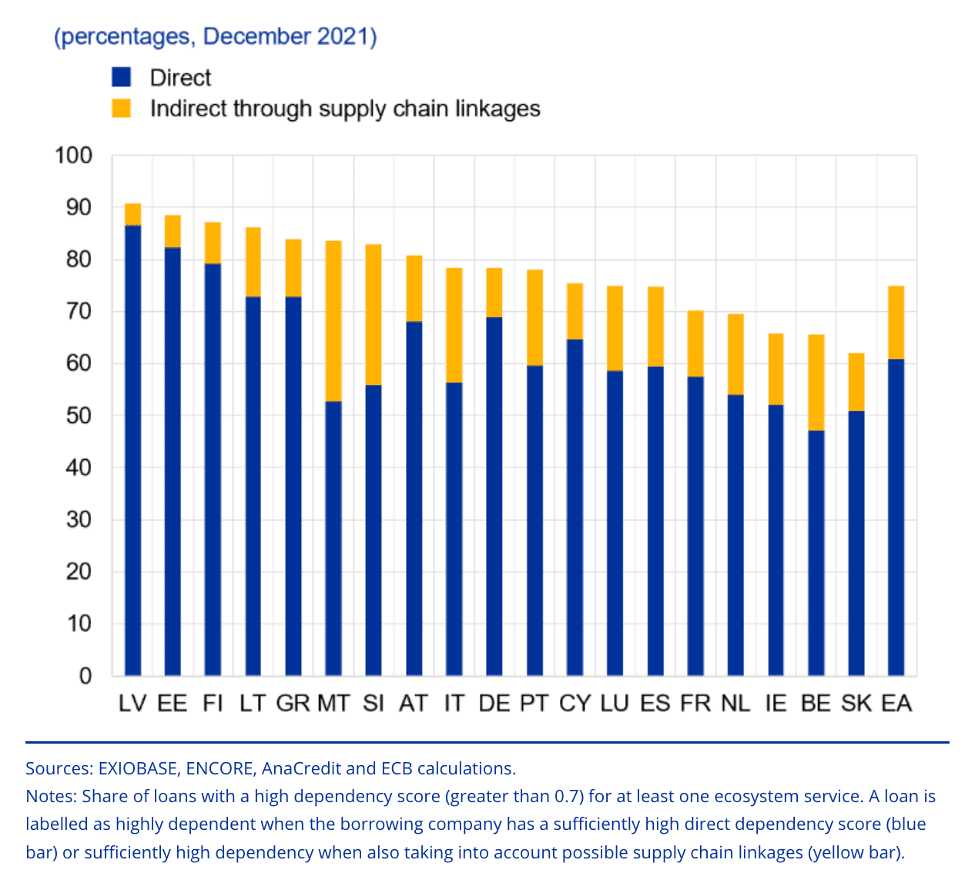

Ecosystem services: the ECB is worried - In a post written last month, Frank Elderson, a Dutch member of the ECB’s Executive Board, noted that the bank has started to look at how 4.2 million companies (representing $4.2tn in borrowing) depend on natural capital for their operations. Biodiversity (see last issue) continues to rise on the sustainability agenda, and professionals in the space welcomed the news that a mainstream bank regulator is now evaluating nature-related risks. The ECB’s initial work found that three-quarters of companies in the euro area depend heavily enough on ecosystem services (think of nature’s provision of clean air, protection against natural disasters, carbon uptake and storage, erosion control, and drinking water) that continued impairment of those services would lead to riskier credit portfolios in the banking system. And, through disrupted supply chains, further natural capital degradation could create inflationary risks too. What are the services on which European companies most depend? The ECB is most worried about erosion control, water supply, flood protection, and carbon uptake and storage. Of note, differences between countries in the euro area are quite modest:

The future of European tourism - As wildfires swept across Greece and tens of thousands of holiday-makers were forced to evacuate Corfu and Rhodes, hospitality industry observers asked longer-term questions about the viability of tourism in southern Europe as a whole. The Acropolis had to be closed early, and tourists in Sardinia were confined indoors as temperatures reached 45 degrees. Searches for northern European destinations were up 1,000 percent, according to travel website eDreams, and the hippo at Rome’s Biparco Zoo was fed frozen watermelon to keep it cool. Concerns about “over-tourism” in Greece, which surfaced in late 2022 after visitors outnumbered citizens by 3:1, may be premature. Tourism accounts for around 15% of Greece’s GDP, and 8-10% of Italy’s and Spain’s. The winter corollary for increasing latitude in tourism preferences, is increasing altitude instead. This past winter, amid mass early closures of resorts in France, skiers found 1,700m was the elevation generally required to enjoy snow. If snow counts as an ecosystem service, then the ECB is already right: lenders to many European hotels have riskier credit portfolios.

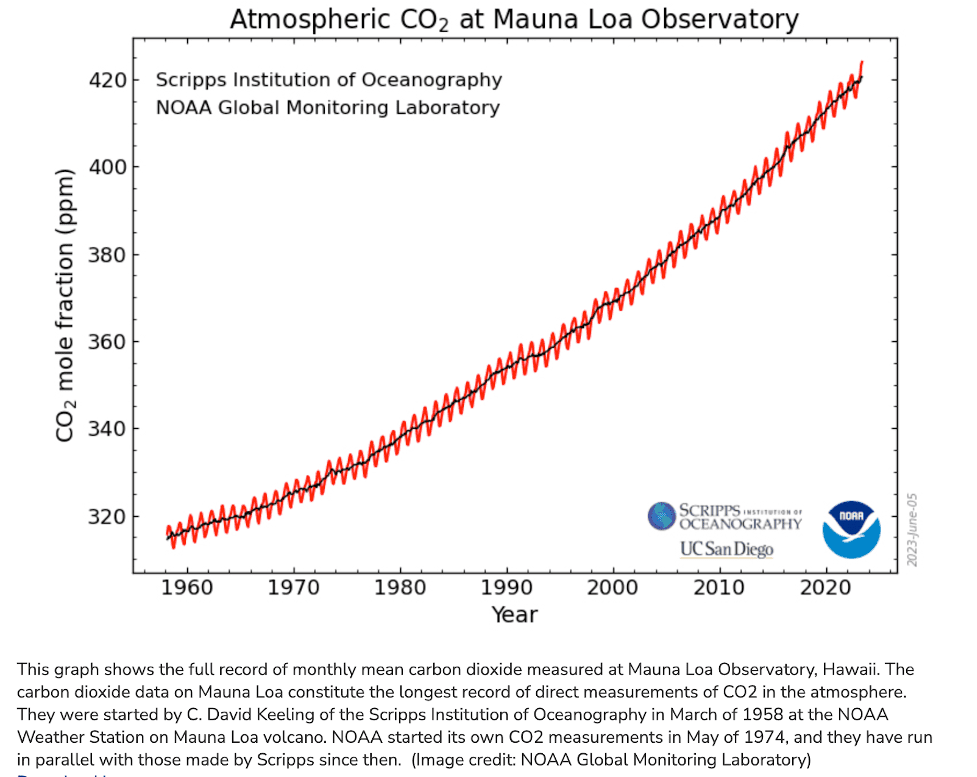

Atmospheric CO2 concentration: a large jump - Pop quiz: In which month every year does atmospheric CO2 concentration peak in the northern hemisphere? It’s in May, just before growing season. This past May, NOAA data collected at its Mauna Loa monitoring station showed CO2 reaching 424.0 ppm, or 3.0 ppm higher than last year’s figure. This year-on-year jump is the fourth-highest on record. Last year, when carbon dioxide hit 421 ppm, a different – and no less sobering – milestone was passed, which is that our atmosphere was officially 50% richer in CO2 than the 280 ppm the planet enjoyed in 1750. The chart below is known as the Keeling curve, after Charles David Keeling, the scientist who first started measuring atmospheric carbon dioxide’s seasonal and annual variations in the 1950s.