In this month’s newsletter, we look at potential progress associated with COP 28 that is wrapping up as we write, 2023’s record-breaking emissions, as well as asset owner allocation trends, and data from Pitchbook on impact fund performance.

COP review – With COP 28 winding down, we’re broadly skeptical about the outcomes of the meeting. Although it’s encouraging that the words “fossil fuel” were used for the first time in COP language, we are skeptical it will amount to much if it doesn’t specifically call for phasing out fossil fuels. And the second draft, released on Wednesday Dubai time, has no explicit commitment to “phase down” (let alone “phase out”) fossil fuels. Four geographies matter: If the US, China, Europe and India don’t start to at least “phase down” fossil fuels, the outlook for meeting Paris Accord targets becomes bleak. For every year that passes without accelerated progress, the measures needed become even more challenging. If anything, the progress on the Loss and Damage fund announced at the beginning of this COP (which we discussed in our newsletter about last year’s COP) potentially implies resignation about exceeding the Paris targets and focusing on adaptation in lieu of mitigation. The draft language could change from here however, so stay tuned.

What level are emissions actually at? The context for COP28 is (perhaps) under-reported, in that global carbon emissions are still rising: in 2023, they will reach a record high. This report, published this month by Stanford’s Doerr School of Sustainability and Exeter University, notes that on the current path, global temperatures will surpass 1.5 degrees above pre-industrial levels by 2030, and 1.7 degrees soon after that (today, we are about 1.1 degrees above 1850’s levels). The U.S. has managed to trim emissions by 3% relative to 2022, but global carbon dioxide-equivalent emissions will exceed 40 billion metric tons this year, including ~36 billion tons from fossil fuels (the other ~4 billion tons come from land use changes, like deforestation). Globally, that’s an increase of 1.1% from 2022.

Continued mainstreaming of impact investing - In addition to increasing their focus on ESG, more institutional investors are incorporating impact investing in their portfolios. Earlier this year, Schroders published results of its annual institutional investor survey (which covers 770 institutions, including corporate and public pension plans, official institutions, endowments and foundations collectively representing ~$35tn in assets). Two-thirds of respondents said decarbonization would drive innovation and create investment opportunity, and a similar proportion indicated interest in green hydrogen, nature-based solutions and similar new sectors for increased portfolio diversification. Furthermore, private assets are the preferred approach to accessing these impact opportunities. “54%” Schroders writes, “are seeking to proactively allocate to harness the investment opportunities presented by the energy transition and technological revolution though a greater exposure to private assets.” These figures extend a trend toward impact documented in the 2020, 2021, and 2022 editions of the survey. The difference between ESG and impact? ESG is about how you run your business, while impact investing is about the positive social and environmental benefits your business’s product delivers.

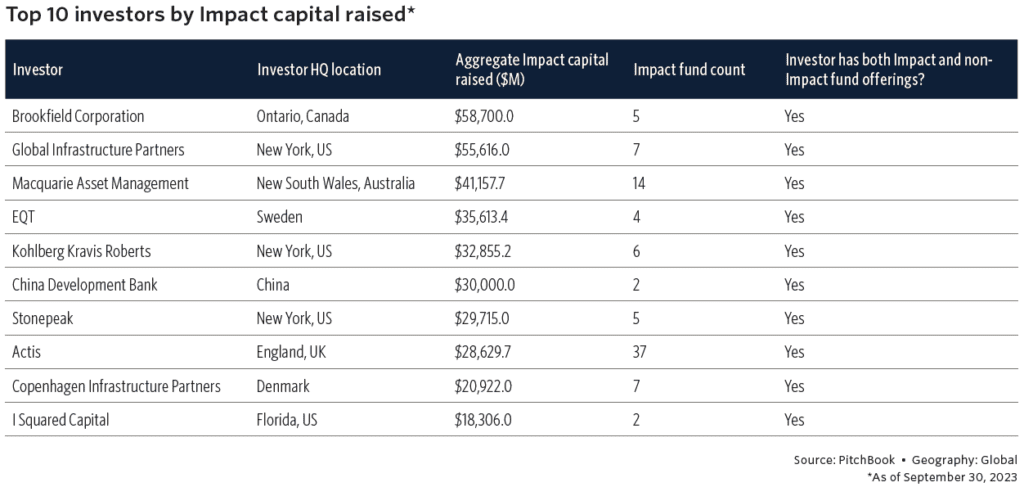

Impact strategies and asset classes The chart below highlights Pitchbook’s latest tally of the AUM of impact strategies at large asset managers:

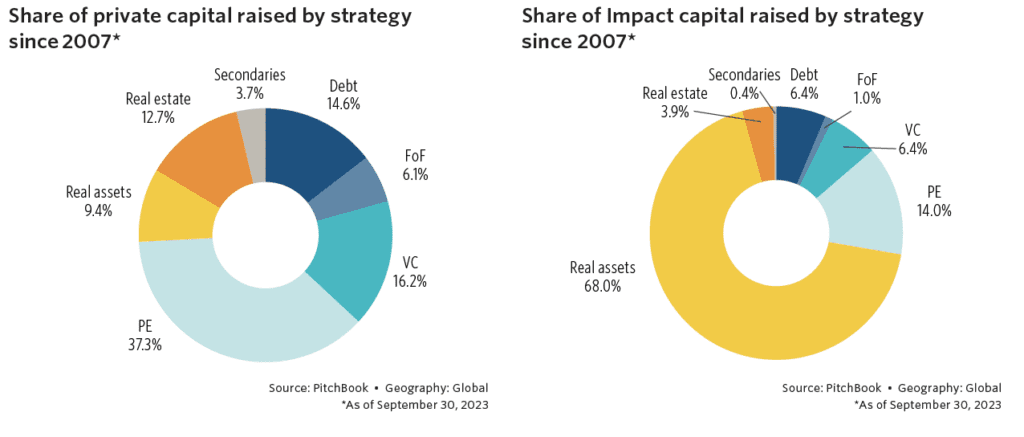

What leaps off the page is the role of real assets as the principal approach asset owners are using to access impact themes. This largely makes sense given the lower volatility and regulatory momentum behind clean energy infrastructure, in addition to the need for vast amounts of capital. Indeed, real assets represent a disproportionate amount of capital in impact portfolios relative to non-impact portfolios.

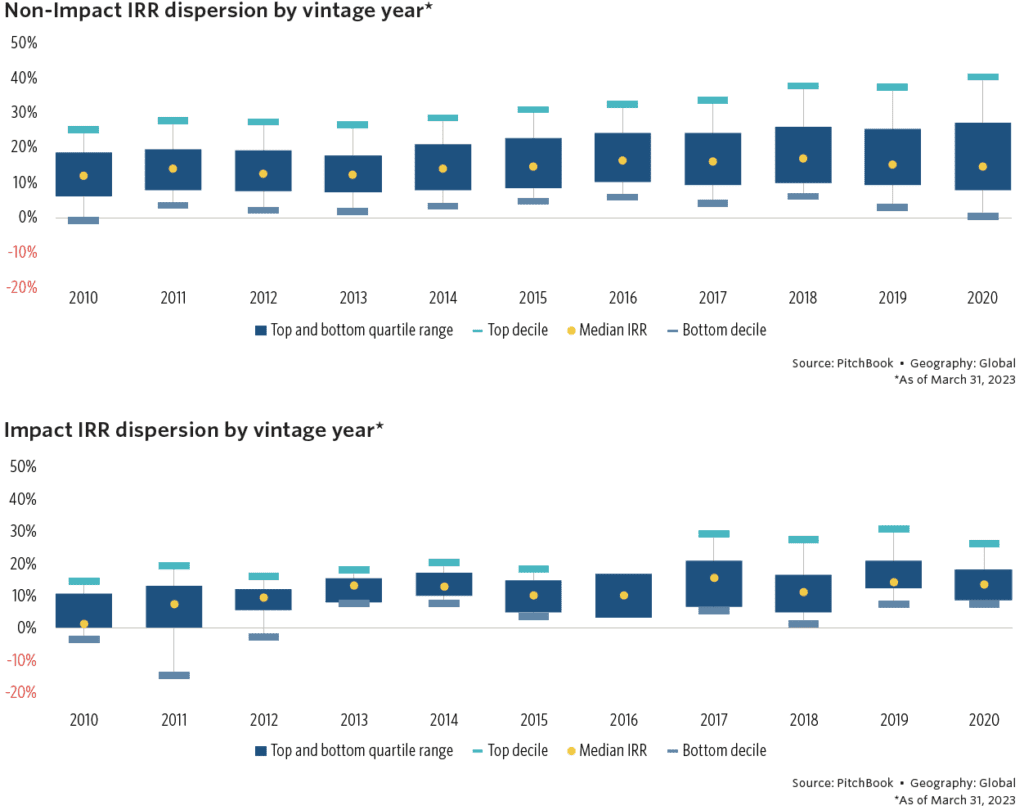

Impact vs. non-impact funds: Don’t forget about risk – One complaint about impact investing is that investors may need to sacrifice returns for impact. The biggest challenge in quantitatively answering this question is that there are far fewer impact funds than non-impact ones. So with a smaller sample size, a few outliers can skew the interpretation. What is more relevant for this context is that the dispersion of the quartiles tends to be much tighter with impact funds. The returns data from Pitchbook (below) is challenging as it’s all private market investments and doesn’t distinguish by asset class. But given the high representation of real assets, it’s not terribly surprising that there could be lower volatility in impact funds. This means that even though the highest performing decile of funds predominantly comprises non-impact funds, the volatility of non-impact fund performance is also higher. Indeed, in some years the lowest quartile of impact funds performs better than the lowest quartile of non-impact funds, meaning “returns-only” investors underperform impact investors. With more institutional investors allocating to impact, in a few more years sample sizes will be large enough to allow deeper analysis of impact-related risk-adjusted returns. In the interim, the takeaway from Pitchbook’s data is that there’s weak evidence that risk-adjusted returns suffer, on average, by focusing on impact. Our view is that this is similar to ESG – if investors focus on impact or ESG factors that are material to the business, competitive returns can result.

We wish everyone a wonderful holiday season.