Hello from Impact Delta.

At the CERAWeek annual oil and gas/energy conference last week, Jigar Shah (head of the U.S. Department of Energy’s clean tech loan program) said, "I do think that today we view ourselves as one energy industry, not a clean energy industry and a dirty energy industry," which raises the question: Is oil and gas really committed to decarbonizing? Also in this newsletter, we look at the recent SVB collapse and potential collateral damage, as well as the start to the 2023 proxy voting season.

CERAWeek - The annual CERAWeek conference convenes the CEOs of the largest oil companies around the world, and increasingly includes some of the leading lenders and operating companies driving the transition to clean energy. However, the commitment to energy transition seemed to be losing, rather than gathering, strength. Discussions focused on new gas development as the next stage for the industry. Indeed BP's comment last month that it aiming to reduce oil production in 2030 by 25% rather than 40% is consistent with the tone of modest progress evident throughout the event. Jigar Shah's comment likely reflects the political constraints of the Biden administration, which needs to be seen to keep oil prices/energy costs low while still promoting a shift to clean energy.

Oil and gas leasing developments in Alaska - On the topic of the administration keeping oil prices low, a key topic at the conference was the decision about the Willow Oil project in Alaska. Environmentalists oppose the project, as it both sets back progress to achieve Paris climate accord targets, and affects a previously undisturbed wilderness in Alaska. This week, the Biden administration did move forward to approve this project, albeit with a narrower scope than ConocoPhillips requested (3 drilling sites instead of 5). The political demands of keeping inflation low, and shielding consumers from higher energy prices are proving strong enough to offset some of the federal subsidies and policy support for clean energy found in the Inflation Reduction Act (IRA).

Capital, labor, or regulations as the bottleneck? – Even with the decarbonization of energy underperforming near-term expectations, the hundreds of billions of support in the Inflation Reduction Act for clean technology deployment are still expected to accelerate the transition. However, even with the influx of capital, it remains unclear if the IRA’s potential can be realized if regulations or labor constraints are not addressed. Anyone who has tried to install solar panels at home will appreciate that local building, fire, and zoning codes can substantially delay construction. Indeed, the Biden administration is seeking to streamline the permitting process, although it can only go so far without local support. Even if these barriers are overcome, the labor for scaling the infrastructure remains in in short supply: the industry currently is struggling to add the roughly 500,000 workers annually that are needed to meet the administration's targets.

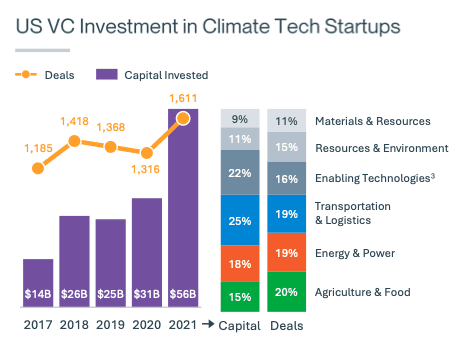

SVB - The failure of Silicon Valley Bank has dominated the headlines over the past week. Although it now appears that a systemwide banking crisis has been averted, there are two potential implications we will be watching closely. First, SVB's demise may have negative impacts on the climate tech industry. As the chart below (from SVB no less) shows, climate tech VC funding has increased dramatically over the past four years. It now accounts for roughly 20% of all VC funding. Not only that, the use of venture debt is slightly higher in climate tech, as it often requires more capital than other venture-backed sectors. SVB was a substantial supplier of venture debt, so its bankruptcy many slow the growth of the climate tech ecosystem.

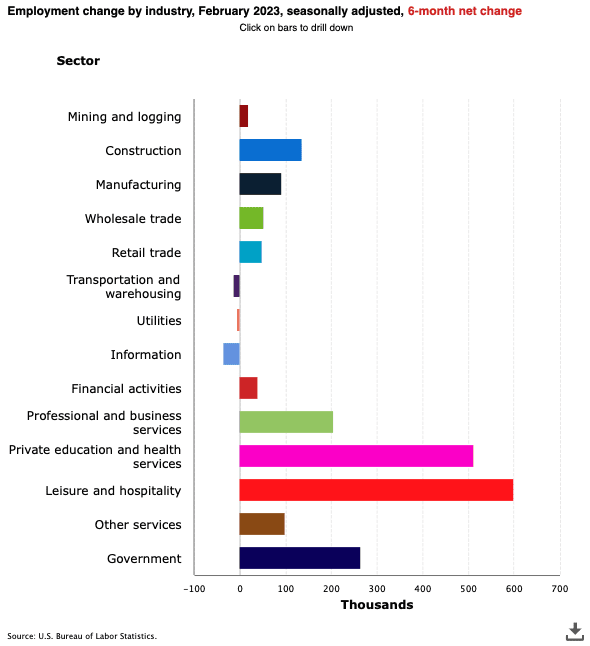

The second knock-on effect we will be watching is employment. If the banking industry seeks to address the volatility of the SVB fallout by reducing costs, we could see significant job losses (see chart below from the Bureau of Labor Statistics). With tech (labeled “information”) and “financial” typically having above average compensation, layoffs in these sectors could reduce demand in other sectors (e.g. hospitality and leisure), leading to a significantly cooler labor market overall. We’ll be watching whether this leads to a soft landing or reduces inflationary pressure.

It's time for another proxy season - As the 2023 proxy season gets underway, we are likely to see more shareholder resolutions and, thanks to pending SEC rule changes, more shakeups in board composition. Beyond this governance impact, we also expect to see more “E” and “S” shareholder proposals. The percentage of these proposals that will be approved is likely to decline (as has been the case over the last few years), but the absolute number that are approved may go up. So, we will be watching to see the extent to which incumbent board members are held to task, as well as which E and S themes investors deem to be the most material and worth supporting.

The Impact Delta Team

contact@localhost

About Impact Delta

A secular shift towards a more responsible capitalism is underway. Impact Delta is a specialist consultancy founded to help investment firms capitalize on this shift. We believe good environmental and social thinking helps investment firms raise capital and earn better returns. More about us here.