Sourcing key metals directly can help with traceability.

Hello from Impact Delta.

Enjoy our periodic newsletter, containing insights and news related to ESG and impact investing. In this edition, the temporal impact of oil and gas vs renewable investment performance, continued momentum in electrification of transit, and earth day pictures from Google that underscore climate change.

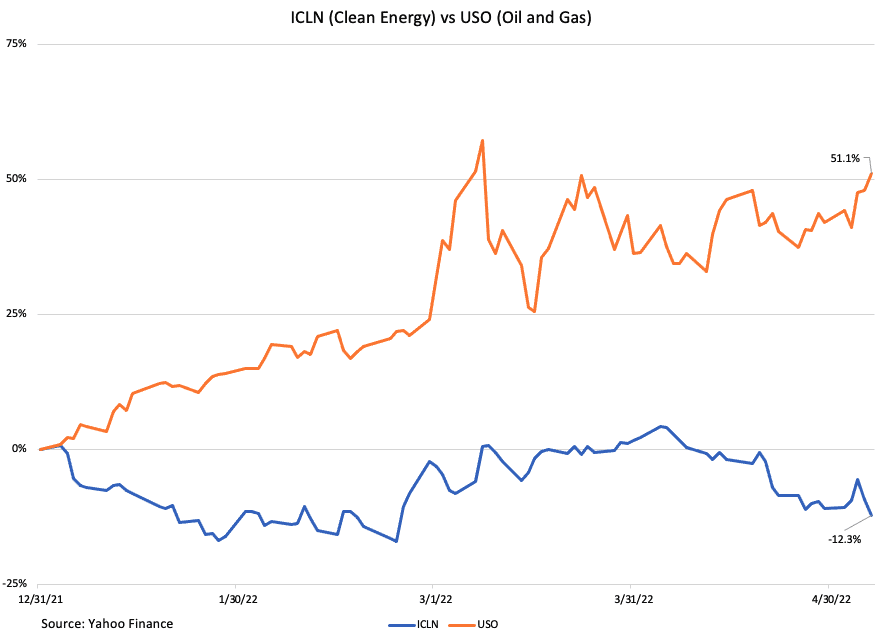

The tradeoffs of divest vs invest - The growth of investment in renewables over the past few years has led some investors to consider divesting from oil and gas, while others have chosen to remain invested, but engage with the companies through proxy voting. The divestment argument had gained momentum, as investors that were underweight oil and gas were outperforming with oil and gas lagging the broader market for much of the last 5 years. However, year to date, that has switched, as evidenced by the performance of one of the leading clean energy ETFs against a leading oil and gas ETFs.

It will be interesting to watch how this evolves over the next few quarters as raising interest rates, the Ukraine war and other factors cause volatility in the market short term.

But the long-term trend toward renewables is still clear - Shell recently announced a partnership with ABB to develop electric vehicle charging infrastructure. The objective is to have 500,000 chargers by 2025 and 2.5 million chargers globally by 2030. This is similar to a move BP made last year in partnering with Volkswagen to develop charging infrastructure, often at company owned retail stations. So even if the companies are currently minting money in oil and gas, these investments indicate they understand where the world is headed in the long-term.

Mining and minerals are likely the next frontier - Inflation has grabbed the headlines of late, with Tesla as no exception. The base price of a Tesla model 3 has jumped 30% over the last year, trending with the increased prices of lithium, cobalt and nickel. Despite this, Tesla has outlined in its impact report details on which mines deliver these materials to its battery manufacturing partners. More importantly, the company has outlined how it is able to source a majority of its battery supplies directly from mines, enabling greater control and traceability. As EV adoption accelerates, this focus on supplies may become a key differentiation.

Speaking of Tesla, they are now more profitable than GM or Ford - In the first quarter of Q1, Tesla earned $3.31 Billion, compared to $2.93 Billion and $2.3 Billion for Ford. This is despite selling far fewer vehicles (310k vs. 980k for Ford and 1,427k for GM). Regulatory credit revenue was a significant contribution ($679 Million of revenue), helping make the company more profitable, although Tesla remains more profitable per vehicle than either legacy automaker.

Images of Climate Change in Action - Around Earth Day (April 22), Google released this series of contrasting images from Greenland, Mt Kilimanjaro, the Great Barrier Reef, and the decimation of a forest in Germany.

Feedback is always encouraged and welcome. If this was shared with you, you can subscribe here.

About Impact Delta

A secular shift towards a more responsible capitalism is underway. Impact Delta is a specialist consultancy founded to help investment firms capitalize on this shift. We believe good environmental and social thinking helps investment firms raise capital and earn better returns. More about us here.